Enabling online transactions on your SBI debit card is straightforward. You can do it in a few simple steps.

This guide will show you how. Many people use SBI debit cards for online shopping and payments. Sometimes, these transactions don’t work if the feature isn’t enabled. This blog will help you activate online transactions. You’ll learn how to do it quickly and easily.

Whether you are new to online banking or looking for a simple guide, this post has you covered. Follow these steps to enjoy smooth online transactions with your SBI debit card. Let’s get started.

Credit: www.mysmartprice.com

Pre-requisites

Enabling online transactions on your SBI debit card is simple. But you need to meet certain pre-requisites. These pre-requisites ensure a smooth process.

Eligibility Criteria

Before enabling online transactions, check if you meet the eligibility criteria:

- You must have an active SBI debit card.

- Your card should be linked to an active SBI account.

- Your mobile number must be registered with the bank.

Necessary Documents

To enable online transactions, you need to have certain documents ready. These documents help verify your identity and ensure security:

| Document | Purpose |

|---|---|

| Aadhar Card | Identity Verification |

| PAN Card | Tax Identification |

| Registered Mobile Number | Receive OTP for Transactions |

| Bank Passbook | Account Verification |

Having these documents ready will make the process easier.

Activating Internet Banking

Activating internet banking for your SBI debit card is a vital step. It allows you to manage transactions online. This process involves a few simple steps. Let’s dive into the details.

Registration Process

First, visit the official SBI net banking site. Click on the ‘New User’ option. Enter your account number and fill in the required details. Ensure all the information is correct. Submit the form to proceed.

Setting Up User Id And Password

Once registered, you need to set up a user ID. Choose a unique ID that you can remember. Next, create a strong password. Use a mix of letters, numbers, and symbols. This ensures your account stays secure.

Confirm your password by entering it again. Submit the details. Your internet banking is now activated. You can now manage your SBI debit card online.

Logging Into Sbi Online Portal

Enabling online transactions on your SBI debit card is straightforward. The first step involves logging into the SBI Online Portal. This guide will walk you through the process, ensuring you can access and manage your debit card settings with ease.

Accessing The Portal

To access the SBI Online Portal, follow these steps:

- Open your web browser and go to the SBI Online Portal.

- Click on the Login button at the top right corner.

- Select the Personal Banking option.

- Enter your Username and Password.

- Click on the Login button to proceed.

Navigating The Dashboard

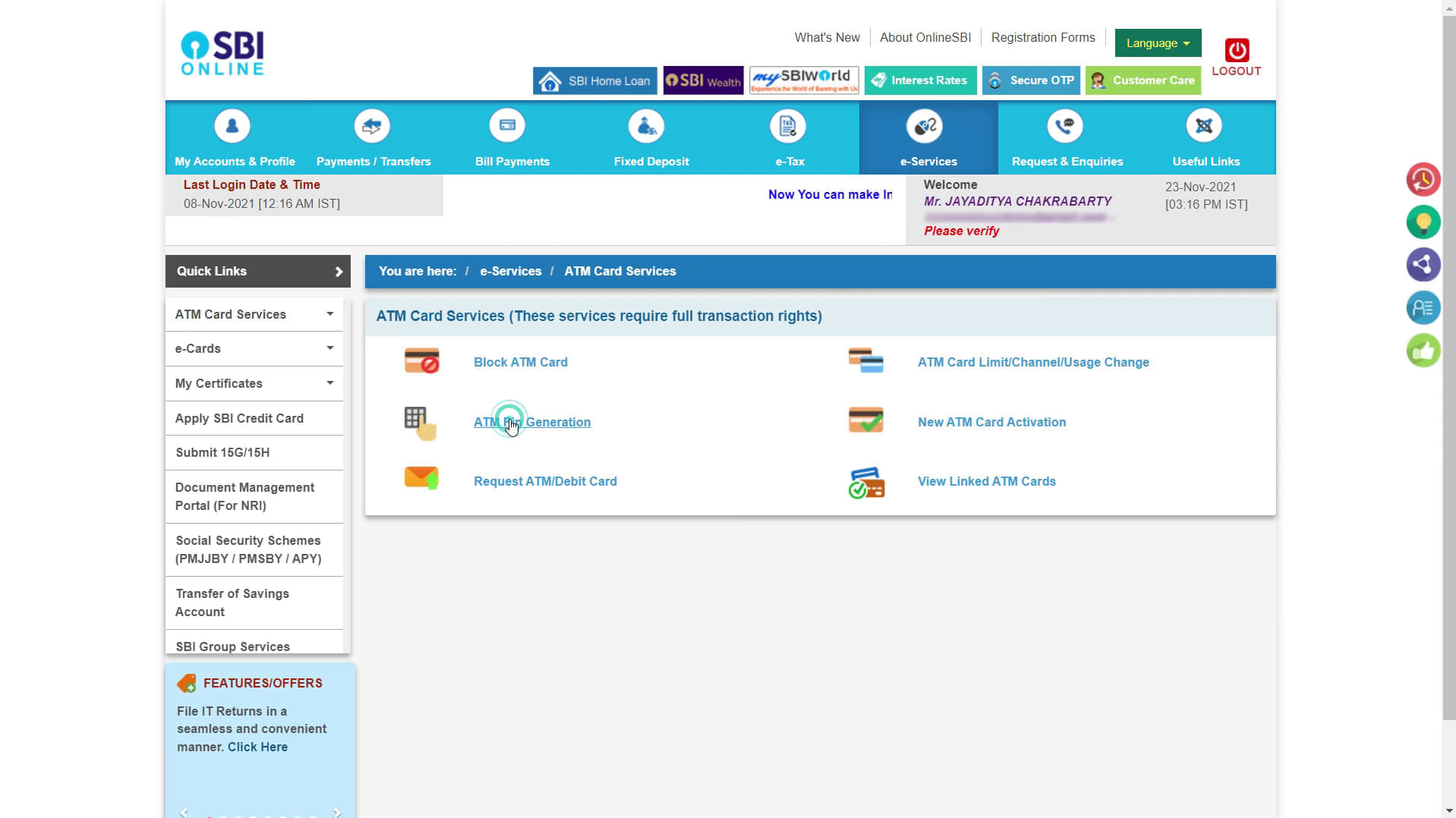

Once logged in, you will be redirected to the dashboard. Here’s how to navigate it:

- On the left menu, click on e-Services.

- Select ATM Card Services from the drop-down menu.

- Choose the Manage Card Usage option.

- Select your debit card from the list displayed.

- Enable the Domestic Usage and International Usage options as required.

- Click on the Submit button to save your settings.

Following these steps will allow you to enable online transactions for your SBI debit card. Make sure to review all settings carefully before submitting.

Credit: www.youtube.com

Enabling Online Transactions

Enabling online transactions for your SBI debit card can be a straightforward process. It allows you to shop and pay bills online securely. Follow these steps to activate online transactions and enjoy a seamless digital experience.

Locating Card Services

First, log in to your SBI net banking account. You will see various options on the dashboard. Look for the ‘e-Services’ tab. Click on it to proceed to the next step. This tab contains essential card management services.

Selecting Transaction Options

Within the ‘e-Services’ tab, find and click on the ‘ATM Card Services’ option. This section allows you to manage your card settings. Next, select the ‘Manage Card Usage’ feature. It lets you customize your card for different types of transactions.

Check the box for ‘Enable International and Domestic Online Transactions.’ This action will activate your card for online purchases. Confirm your choice by clicking on ‘Submit.’ A confirmation message will appear on your screen. Your card is now ready for online transactions.

Setting Transaction Limits

Setting transaction limits on your SBI debit card enhances security. It ensures that you stay within your planned spending. You can control how much you spend and where you spend it. This feature helps in managing finances better. It also prevents unauthorized high-value transactions.

Defining Daily Limits

Daily limits control how much money you can spend each day. You can set limits for ATM withdrawals and online transactions. These limits are important for budget management. They also add an extra layer of security. You can decide the amount based on your needs. It is advisable to keep it within a reasonable range.

Updating Limits As Needed

Updating your transaction limits is simple. You can do it through SBI’s internet banking portal. First, log in to your account. Then, navigate to the ‘e-Services’ tab. Select ‘ATM Card Services’ and choose ‘Change ATM Limit’. Enter the new limit and confirm.

For online transactions, go to the ‘E-commerce’ section. Select ‘Manage Cards’ and update the limit. Changes are instant and effective immediately. Regularly review your limits. Adjust them according to your spending habits. This ensures you always stay within your budget.

Security Measures

Ensuring the security of your SBI debit card during online transactions is crucial. This section covers the essential security measures you need to implement. By following these steps, you can safeguard your transactions from unauthorized access and fraud.

Setting Up Otp

One-Time Password (OTP) is a vital security feature for online transactions. Here’s how to set it up:

- Log in to your SBI online banking account.

- Navigate to the ‘Profile’ section.

- Select ‘High-Security Options’.

- Choose ‘Enable OTP for online transactions’.

- Verify your mobile number and email address.

- Confirm the setup by entering the OTP sent to your mobile.

OTP adds an extra layer of security, ensuring only you can approve transactions.

Enabling Two-factor Authentication

Two-Factor Authentication (2FA) further enhances your card’s security. Follow these steps to enable it:

- Log in to your SBI online banking account.

- Go to the ‘Security Settings’ section.

- Select ‘Two-Factor Authentication’.

- Choose your preferred second factor (SMS, email, or app-based authentication).

- Follow the prompts to complete the setup.

2FA ensures that even if someone knows your password, they can’t access your account without the second factor.

By setting up OTP and Two-Factor Authentication, you significantly reduce the risk of fraud. Always keep your contact information up-to-date to receive security alerts promptly.

Troubleshooting

Enabling online transactions on your SBI debit card can sometimes pose challenges. Understanding common issues and knowing how to seek help can ease the process. Let’s dive into some frequent problems and how to address them.

Common Issues

One common issue is the incorrect entry of card details. Double-check your card number, expiry date, and CVV. Another frequent problem is the card not being activated for international transactions. Ensure your card is enabled for global use if needed.

Sometimes, your card may be blocked for security reasons. Contacting the bank can resolve this. Also, ensure your internet connection is stable during the transaction process. Poor connectivity can lead to failed attempts.

Customer Support

If issues persist, reach out to SBI customer support. They are available 24/7 to assist. You can call their helpline or visit the nearest branch. Explain your problem clearly for a quick resolution.

For online assistance, use SBI’s official website or mobile app. Navigate to the support section and submit your query. They usually respond promptly with a solution.

Remember to keep your card details and identification handy. It helps in quicker verification and resolution of your issues.

Credit: cleartax.in

Frequently Asked Questions

How Can I Activate Online Transactions On My Sbi Debit Card?

Log in to SBI net banking. Go to e-Services > ATM Card Services > Manage Usage. Enable online transactions.

What Are The Steps To Enable Online Transactions?

Log in to SBI net banking. Choose e-Services > ATM Card Services > Manage Usage. Enable online transactions.

Is It Safe To Enable Online Transactions On Sbi Debit Card?

Yes, it is safe. SBI uses secure methods and two-factor authentication to protect your transactions.

Can I Enable Online Transactions Through Sbi Yono App?

Yes. Open SBI YONO app. Go to Service Request > ATM/Debit Card. Enable online transactions.

How Long Does It Take To Activate Online Transactions?

It activates immediately after you enable the online transactions through net banking or YONO app.

Conclusion

Enabling online transactions on your SBI debit card is simple. Follow the steps outlined in this guide. Secure your online purchases with ease. Enjoy the convenience of digital payments. Managing your finances becomes effortless. Stay updated with SBI’s latest features.

Your online transactions are now just a few clicks away. Make sure to keep your card details safe. Embrace the digital banking experience with confidence. Happy banking with SBI!